How do you stretch your entry-level salary to cover rent, groceries, transportation, and hobbies while still saving for the future?

That was the challenge facing Arapahoe High School juniors and seniors during the “Adventures in Reality” personal finance simulation on November 4. Students stepped into the world of budgeting, career planning, and money management in a hands-on event designed to bring their classroom learning to life.

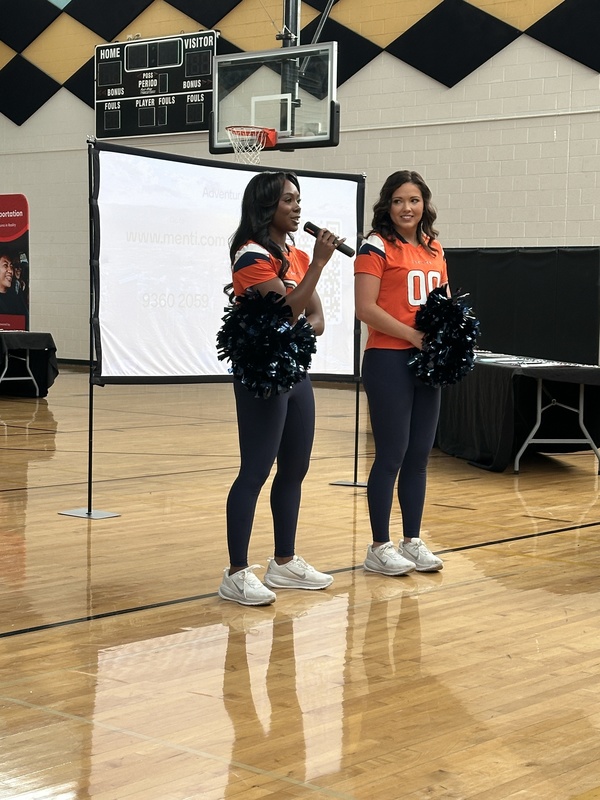

The event, now in its second year at Arapahoe, was coordinated by the business department, including teachers Howard Wolsky, Caroline Swank, and Jeannie Maney in partnership with ENT Credit Union and the Denver Broncos. The simulation is part of a larger statewide initiative by ENT to provide financial literacy experiences to high school students. This in-school event offers a powerful experience without requiring students to miss any other classes.

“This is a barrier-free way for our students to engage in critical, real-life financial decision-making,” said Wolsky.

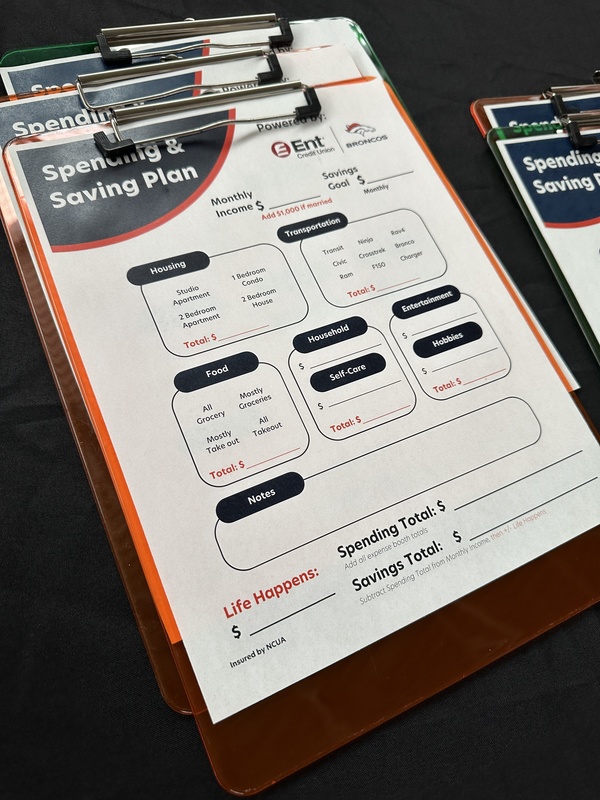

The simulation began with a presentation from ENT credit union followed by students interacting with real-life scenarios. Students were assigned a career, complete with Colorado-based entry-level salary data, and a family situation. Then they visited stations for housing, transportation, food, hobbies, and more, making financial decisions with their means. Some students had partners and children to consider, adding complexity and realism to their budgeting.

The event wasn’t just about numbers; students were asked to reflect on personal values and priorities: What do you value? How do you choose to spend your money? Can you cover your needs, enjoy your wants, and still save for the future?

“This simulation reinforces what we teach in our personal finance classes, but when students hear it from real-world partners like ENT and the Denver Broncos, the message often resonates more deeply,” said Swank.

Personal finance is a required course at Arapahoe High School, aligned with Colorado’s financial literacy standards and offering both high school and concurrent enrollment (college course) credit. The course covers everything from taxes and insurance to credit and investing, and experiences like this simulation give students a glimpse of what financial independence really looks like.

No matter what career path students choose, financial literacy is essential.